Friday, February 10, 2006

Friday, December 30, 2005

Governor Thanks CLT

Saturday, December 17, 2005

Thursday, December 08, 2005

Press Release: Romney Signs Bill Abolishing Retroactive Tax

FOR IMMEDIATE RELEASE:

December 8,

CONTACT:

2005 Julie Teer

Felix Browne

(617) 725-4025

Tens of thousands of taxpayers spared retroactive tax bills from 2002

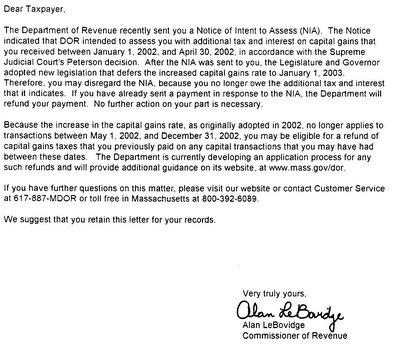

Governor Mitt Romney today signed legislation that prevents thousands of Massachusetts taxpayers from having to pay retroactive taxes on financial transactions that occurred more than three years ago. Under the new law, no additional taxes are due and affected taxpayers may disregard any retroactive bills they received.

“By making this important correction we will keep faith with the taxpayers and prevent thousands of families from enduring any financial hardship from an unfair retroactive tax,” said Romney. “I commend the Legislature for approving a solution that fixes this problem once and for all.”

The change in the law was made necessary by an April 26, 2005 decision of the Supreme Judicial Court, which found that a 2002 state capital gains tax increase violated the Massachusetts Constitution because it took effect May 1, part way through the year.

The court set the effective date of the tax increase at January 1, 2002. However, this action exposed nearly 50,000 taxpayers to an additional $200 million in state taxes on gains realized during the first four months of 2002.

Through a bill filed in June and an amendment made to existing legislation last month, Romney proposed to set the effective date of the tax law change at January 1, 2003, a change that would prevent retroactive taxation. Earlier this week, the Legislature adopted Romney’s proposal.

“This difficult issue was the result of two highly unusual Supreme Judicial Court decisions,” said House Speaker Salvatore F. DiMasi. “Working together, we have delivered a swift and fair resolution to the taxpayers of the Commonwealth.”

“The passage of this bill is a real victory for taxpayers,” said House Minority Leader Bradley H. Jones Jr. “This is a great example of how the voice of the citizenry can positively impact public policy.”

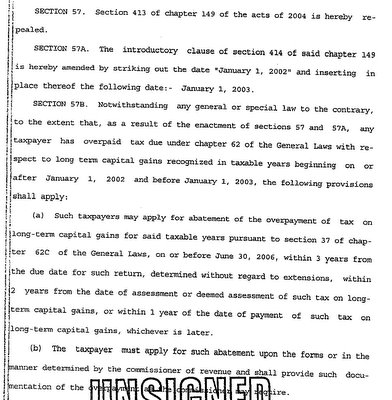

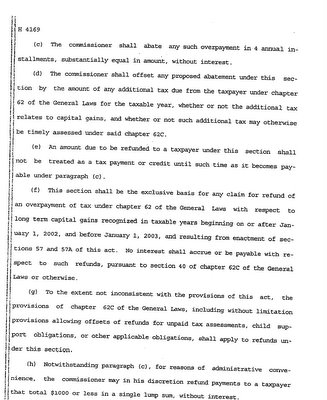

With the change in date, the state is required to refund between $225 million and $275 million to the estimated 157,000 taxpayers who paid the higher capital gains tax rate in the last eight months of 2002. To lessen the impact of these refunds on the state treasury, payments will be spread out over four years. Anyone owed a refund of $1,000 or less will receive one lump sum. Eligible taxpayers must apply for the refund before June 30, 2006.

“Retroactive taxes are simply unfair,” said Senator Cynthia Creem. “People make financial decisions based upon the tax consequences and they need a stable and predictable tax system.”

“If this tax situation hadn’t been corrected I’m not sure how we would have afforded our son’s last two years of college,” said Loretta LaCentra of Revere. Loretta and her family would have owed nearly $100,000 from the sale of a long-time family asset if the law had not been changed.

“I think I can speak for thousands of other taxpayers like us who breathed a huge sigh of relief when we found out we didn’t have to worry about this anymore. A lot of people are very thankful to Governor Romney and the Legislature for doing the right thing,” she added.

“The Legislature did the right thing in agreeing to stop this unfair retroactive tax increase,” said Massachusetts High Technology Council President Christopher R. Anderson. “This process shows that Massachusetts residents can have an impact on important issues like tax policy when they engage in the debate.”

###

Wednesday, December 07, 2005

Monday, December 05, 2005

Legislature passes repeal

Well, OK, in principle the governor could veto it but even I'm not so much of a skeptic that I think he'd veto a bill he was pushing for and already agreed to sign.

I want to give my personal thanks to everyone who contributed to this effort. Whether you called your legislators, wrote a letter-to-the-editor, or just forwarded an email to someone who might be interested, your efforts made this happen.

Associated Press:

Lawmakers pass bill repealing retroactive capital gains tax hike

December 5, 2005

BOSTON --House and Senate lawmakers approved a bill Monday designed to repeal a retroactive capital gains tax hike from 2002 and send out about $275 million in tax rebates over the next four years.

A spokesman for Gov. Mitt Romney said he's expected to sign the bill.

The legislation should bring relief to taxpayers who had begun receiving notices telling them to pay capital gains taxes from 2002.

The problem dates back to the state's most recent fiscal crisis, when lawmakers approved a capital gains hike to begin in May 2002.

The state's top court struck down the tax, saying it was unconstitutional to create a new tax midway through the year. The court said the tax must go into effect either at the start of 2002 or 2003, but not in between.

Under the legislation, anyone who did not pay capital gains taxes during the first four months of 2002 won't be required to pay those taxes retroactively -- and anyone who paid the capital gains taxes during the last eight months of 2002 will get a rebate.

Paying the rebates out over four years will mean a loss of revenue of between $56 and $69 million a year for the state.

Anyone owed $1,000 or less will get a one-time lump sum rebate

Friday, December 02, 2005

More press

Boston Globe, 12/2: Lawmakers to rescind retroactive '02 tax bills

Boston Herald, 12/2: Oh, never mind: Pols to ax retro ’02 capital gains tax

MetroWest Daily News, 12/2: New plan cancels retroactive capital gains

The Boston Herald 12/2: Beacon Hill succumbs to common sense, by Howie Carr. The text is included in the comments to this post.

Thursday, December 01, 2005

We did it!

Associated Press story on boston.com

House, Senate to cancel retroactive capital gains taxes

By Steve LeBlanc, Associated Press Writer | December 1, 2005

BOSTON --Taxpayers who've received notices to pay retroactive capital gains taxes from 2002 could soon be off the hook while thousands more will begin receiving rebates under a plan unveiled by House and Senate leaders on Thursday.

The proposal, detailed by Senate President Robert Travaglini and House Speaker Salvatore DiMasi, would pay up to $275 million in tax rebates over four years to those who paid capital gains taxes during the last eight months of 2002.

It would also absolve anyone from owing retroactive capital gains tax hikes from the first four months of that year.

"Anybody who got a retroactive notice is going to get another notice saying disregard the first notice," Travaglini said.

The proposal closely mirrors a plan floated by Gov. Mitt Romney two weeks ago and comes as lawmakers are under increasing pressure to fix the tax glitch without resorting to retroactive taxes.

Romney praised lawmakers, saying the decision will spare thousands of Massachusetts citizens unfair retroactive taxes.

"This is the right thing to do, and while it will cost the state some money, we can manage it," Romney said in a written statement.

The problem dates back to the state's most recent fiscal crisis, when lawmakers approved a capital gains hike set to begin in May 2002.

The state's top court struck down the tax, saying it was unconstitutional to create a new tax midway through the year. The court said the tax must go into effect either at the start of 2002 or 2003, but not in between.

Republicans lobbied for the tax to go into effect on Jan. 1, 2003, which would have given rebates to taxpayers who paid the tax on financial transactions, such as sales of stocks or real estate, in the last eight months of the year.

Instead, the Democrat-dominated Legislature made the tax go into effect on Jan. 1, 2002. As a result, some 48,000 taxpayers would have had to retroactively pay those taxes on transactions made during those four months, totaling some $200 million.

About $78 million of the estimate was owed by just 278 wealthy people, who would pay an average of $281,000 each. The average among the 48,000 taxpayers is about $4,200.

Democrats said they never intended a retroactive hike, but were forced into it when the court struck down their efforts to create a tax amnesty for the first four months of 2002.

Rank-and-file lawmakers said they had come under increasing pressure to cancel the retroactive taxes.

"In the end it wasn't liberal or conservative, Democrat or Republican, but everyone heard it so frequently and loud and clear," said Sen. Mark Montigny, D-New Bedford, who had argued against the tax. "Ultimately when people started to receive bills, the outcry was loud enough."

House Republican leader Brad Jones said the decision was a victory for taxpayers and the GOP, which had pushed to block the retroactive taxes.

"Do I think that the advocacy of the constituents and the citizens of the commonwealth and the near unanimity in the media had an influence on public policy? Yes, I do," said Jones, R-North Reading.

The Legislature had tried to soften the blow of the retroactive tax.

An $85 million tax loophole bill sent to Romney this week includes a provision that would have waived capital gains tax bills for less than $100, as well as penalties and interest. Romney amended the legislation with his proposal, and returned it to the Legislature.

At that point, lawmakers opted to agree with Romney's plan and abandon the retroactive taxes.

Paying the rebates over four years will mean a loss of revenue of between $56 and $69 million a year, according to Sen. Therese Murray, D-Plymouth, chairwoman of the Senate Ways and Means Committee.

Anyone owed $1,000 or less will get a one-time lump sum rebate, she said.

Share Your Story!

The effect on public opinion when you tell about your own experiences with the Retroactive Tax should not be underestimated.

The consensus among all the lobbyists, news reporters, lawyers, and politicians we talk with is that the negative impact on your life and that of your family will be the key factor in how legislators respond to the Governor’s amendment to the Retroactive Tax Bill.

Here’s why: A growing number of newspapers, including the Globe, Herald, MetroWest Daily News, Worcester Telegram & Gazette, and Lawrence Eagle Tribune and its allied publications on the North Shore and Western Mass have taken a clear position in favor of passing the Governor’s amendment.

But the legislators whose votes will determine the outcome of the issue still don’t have a clear idea of the financial turmoil and emotional pain you are experiencing now that you have received your Retroactive Tax bill.

If you really want to make a difference, both on your own behalf and that of the family and loved ones you have worked for all your life, it’s time to reach out and make your voice heard. Here’s how:

If you feel confident about talking directly to the media, call the newspapers you regularly read and the radio and television stations you listen to and watch. Your right to free speech is protected under the Constitution and no one can do anything to stop you from expressing your opinion.

Letters to the editor can make a real difference, too. Remember to include your full name and phone number at the bottom of letters, even if you request that your name be withheld for reasons of privacy. Papers need to be able to check your story for reasons of veracity, but almost always will protect your privacy in personal matters.

I’ll post a roster of newsroom and producers’ phone numbers in a day or two, but don’t be afraid to call or write on your own, right now. Some people are saying that this whole unfortunate matter can be constructively resolved in the next few weeks and perhaps soon after the turn of the year if those affected speak out right now.

Call and write your legislators, too. Elsewhere on this blog there’s a link to help your find your legislators’ names and contact information. Or call your town or city clerk and tell them your street address. They’ll be able to tell you the names of your representative and senator.

If you need help in telling your story, or just want to talk about where and how to send it, drop an email to petewrites@aol.com. You’ll receive prompt, courteous attention in complete confidence from Peter Golden, who handles our media relations.

Also, when you share your story directly with us, we can bring it to the attention of legislators other than your own. I’ve been told that stories like yours, because they are authentic and come straight from the heart, are a vital element in the campaign to achieve a compromise on the Retroactive Tax issue.

Based on what I’ve heard so far, there are three or four shared scenarios that many of us are experiencing. Each is no less compelling than the other, but when told through your voice becomes even more so, because in your relating it, the story assumes a human dimension that is unique unto itself.

Please allow me to relate some of the “horror stories” I am encountering in the hope they will encourage you to share yours, as well. Remember, these are real people whose pain is no less genuine than yours or mine. They should not be subjected to the abuse they are experiencing, and neither should you.

Here are a few:

- Hundreds of elderly people in a new retirement community in Peabody sold their homes or other substantial assets in 2002 in order to pay the entry fee for their new community. On one entryway alone our contact tells us Retroactive Tax bills range from $8000 to $28000! Think about what that’s doing to those people, the hundreds more living in the complex, and the thousands of elderly people across Massachusetts who must be experiencing similar anxiety and worry as they struggle to come to terms with this brutally unfair burden. Now think about your own situation and the importance of joining the struggle by making your voice heard.

- I’ve also heard about people who sold stock in 2002 to finance college tuitions for their children. Imagine, you work all your adult years to ensure the future of your child and the Legislature wants to tax you twice for an act of loving kindness.

- I’m be re-taxed myself for having the temerity to succeed in business after taking enormous risks with my partners and colleagues. How many of you sold a business in 2002 after years or even decades of hard work and struggle?

- But the story that still lingers longest in my mind is one we read in a letter to the editor prior to its submission to a South Shore paper. In an e-mail from an agonized son describing the travails of his elderly mother, we heard of a woman who is confined to a nursing home after having sold her primary residence and is faced with bankruptcy when she is old and infirm.

I think its high time the public and by association the members of the Massachusetts House and Senate heard the havoc their Retroactive Capital Gains Tax is causing in the lives of honest, tax-paying citizens like you.

Call people, email them, write notes and letters, and get in touch with Peter Golden at petewrites@aol.com; now’s the time to spread the word, now’s the time to act on your own behalf!

What can we do?

If each of us does all of the following it will have a huge impact:

1) Call, visit, and write to your State Representative and Senator. Also have your spouse do all of the above.

Here is a list of legislators by city or town. It also includes links to the legislator’s web site which has phone number, address, and other information. If there are several for your city or town and you aren’t sure which precinct you’re in, you can call your town clerk to find out. Or, follow the instructions here to find out using your street address.

Make sure to say that you are in favor of repealing the retroactive capital gains tax, and you support the Governor’s amendment to HB 4169. The Citizens Against Retroactive Taxation web site www.noretrotax.org has a lot of good information about what to say when you call and how to get your legislator to respond. I recommend it.

Follow up phone calls with a written letter. Here is a link to proper form when writing letters to legislators.

2) Make your opinion and situation known to the media. Write letters to the Boston Globe, the Boston Herald, all of your local papers, and any other media outlets you can think of. Also call in to talk radio.

Letters to the Globe must be 200 words or less and can be submitted using this form.

Letters to the Herald can be emailed to oped@bostonherald.com and should include name, full address, and phone number (only name and town are published -- the rest is for verification).

3) Contact everyone you know who might be affected by this tax or who might be sympathetic. Encourage them to do all of the above actions and visit this BLOG for updates.

Wednesday, November 30, 2005

Some press

Boston Globe article, 11/10: State is Sending Notification of Retroactive Taxes

Lawrence Eagle Tribune (also in Salem News, Daily News of Newburyport, and Gloucester Daily Times), 11/13: It's not fair to raise taxes retroactively. The text is included in the comments to this post.

Boston Herald editorial, 11/22:

Revenues boom, no tax cut in sight

Boston Herald article, 11/23: Tax ax ‘terrible policy’: Ex-Fidelity big’s trust fund hit

Boston Herald article, 11/24: New retro capital tax whack takes toll

MetroWest Daily News article, 11/24: Legislature debates retroactive capital gains tax

MetroWest Daily News letter, 11/26: Capital gains tax fiasco

North Adams Transcript, 11/26: Remedies sought for capital gains tax problem

Boston Globe editorial, 11/29: Taxing Common Sense

CBS4, 11/29:

Thousands Stunned By Capital Gains Tax Change

MetroWest Daily News editorial, 11/30: Fix the retro tax mess

Worcester Telegram & Gazette, 11/30: Ax the retrotax. The text is included in the comments to this post.

Monday, November 28, 2005

Op-ed in MetroWest Daily News

Retroactive tax sends wrong message

By Irwin Jungreis / Guest Columnist

Sunday, November 20, 2005

At the close of the last decade a friend and I left secure positions and started a new business in a risky but promising area of the construction industry. To fund it we invested a fair part of our life savings, raising additional money from other investors.

Within a few years we were employing dozens of people, creating new jobs where none had existed before. We all worked long hours because we believed passionately in what we were doing.

In 2001, like many other businesses, we experienced a significant reversal of fortune in our new enterprise due to the recession following 9/11. To avoid laying people off I took a calculated personal risk and gave up my entire salary for stock. At the time I wondered if I would ever again have a paycheck from my business, or regain even a portion of my investment.

But in April 2002, our risk, sacrifice, and hard work paid off in a way we had not anticipated. A large firm in our industry approached us and we sold our business.

As a result, I received an once-in-a-lifetime capital gain. By design, our employees also participated in the windfall, enjoying a well-deserved reward for their dedication and effort. The American dream had come true for all of us.

But now, after having sold our company and paid our taxes over three years ago, both the founders and employees of our former business will be taxed again by means of a capricious new law. Our lawmakers have rewarded hard work and good fortune with a slap in the face.

How can this be in a state that prides itself on its spirit of enterprise; that tries through scores of incentive and tax give back programs to attract the risk takers and entrepreneurs so vital to maintaining our knowledge-based economy?

Here's how: In 2002, with tax revenues in free fall, the Legislature increased the tax rate on long-term capital gains, with May 1, 2002 slated for the law to go into effect.

In 2005, the Supreme Judicial Court reviewed the Legislature's decision. In Peterson v. Commissioner of Revenue, 444 Mass. 128, the court ruled that the effective date of the tax increase could not be mid-year.

The court then set the increase back to January 1, 2002. Taxpayers who reported capital gains in the first half of 2002 would be billed for the new tax, regardless as to whether they had already paid capital gains under the old law.

Some in the Massachusetts House see the unfairness of this form of public double dipping and are considering a bill (H.B. 4165) that would set the effective date of the increase to January 1, 2003. In doing so they seek to remedy a class of individuals, including my colleagues and me, whose once-in-a-lifetime good fortune has in part been tainted.

Some might say the difference between the old and new rates is only a few percentage points (anywhere from 0.3 percent to 5.3 percent, depending on holding period). How can it be unreasonable to raise the tax rate by a few percent? Won't the change only affect wealthy individuals who can easily afford to pay, and aren't capital gains earned on nothing more than the strength of a phone call and a stock sale?

The rate at which capital gains are taxed in Massachusetts is not at issue here. My position speaks to when one is taxed, and for what reason. A new tax bill issued now to someone who realized income years ago and has already paid taxes does so without reference to personal circumstance and common fairness.

Now it is 2005 and my new, entirely unanticipated, retroactive tax bill is larger than my annual salary.

It is not just for entrepreneurs that the Legislature must maintain a standard of reasonableness. No one should have to live with the fear that improvised law of the most opportunistic sort will create unwarranted penalties disproportionate to circumstance.

The Legislature must act to remedy an unjust law that is both an oversight and an insult to personal initiative and new enterprise.

Irwin Jungreis lives in Sudbury.

Introduction

This BLOG is intended to be an information resource for those who are fighting this retroactive tax increase, whether they are directly affected or only oppose it due to its inherent unfairness.

Here’s how this retroactive tax increase came about. During 2002, the tax rate on long-term capital gains was increased, effective May 1, 2002. In 2005 (Peterson v. Commissioner of Revenue, 444 Mass. 128) the Supreme Judicial Court ruled that the rates cannot be changed mid-year and the court reset the effective date of the increase to January 1, 2002. Taxpayers who reported capital gains in early 2002 are now being billed for the difference between the old and new tax rates, plus three years of interest.

The Supreme court ruling left open to the legislature the possibility to change the effective date of the tax increase to 1/1/03. That would mean that there would be no retroactive tax increase, but it would also mean that the state would have to refund taxes to anyone who reported a capital gain from 5/1/02 – 12/31/02. Such refunds would total over $200 million.

Here is a document from the Department of Revenue with more detailed information on the retroactive tax: TIR 05-13

During November, the legislature passed a bill (HB 4169) which eliminates the interest and exempts anyone for whom the total amount due is less than $100. However, this bill did not become law because the governor did not sign it. Instead, Governor Romney sent it back to the legislature with an amendment that would set the effective date of the tax increase to 1/1/03. Taxes paid at the higher rate for the period 5/1/02-12/31/02 would be refunded to the taxpayers over 3 years rather than all at once to lessen the impact to the state budget, an idea the Governor credits to Senator Cynthia Creem, cochairman of the Joint Committee on Revenue. Here is Governor Romney’s press release: ROMNEY PROPOSES TAX FIX TO PREVENT RETROACTIVE TAXATION

Information on how to fight the tax increase can be found at www.noretrotax.org. That web site was created by CITIZENS AGAINST RETROACTIVE TAXATION, a group formed by Mark Bernardin and others for this purpose.

Some historical perspective on this tax can be found on the web site of Citizens for Limited Taxation here: The Unconscionable Retroactive Tax.